Solar Analysis

Simple Modeling

Some simple modeling for adding solar panels to the church garage.

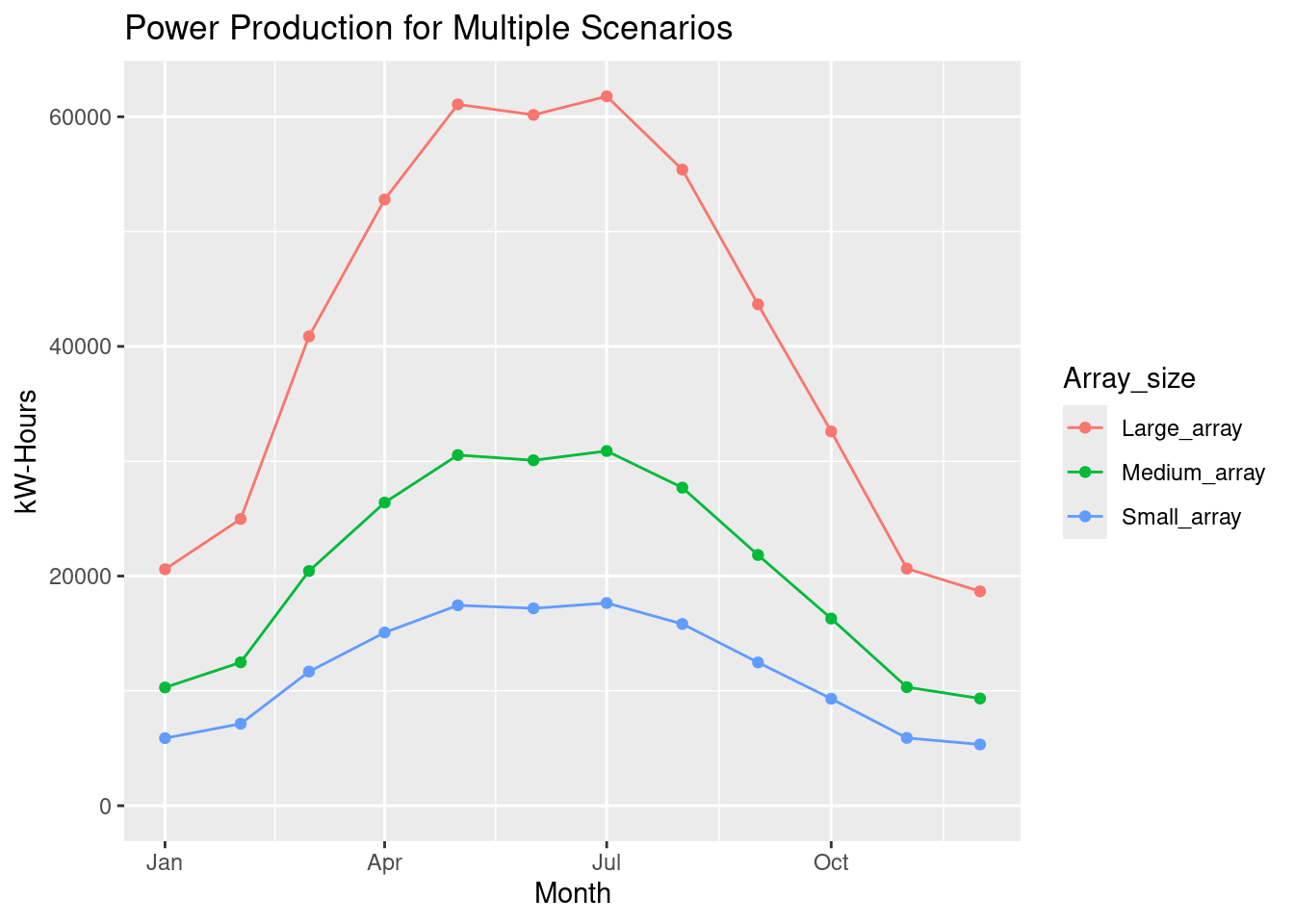

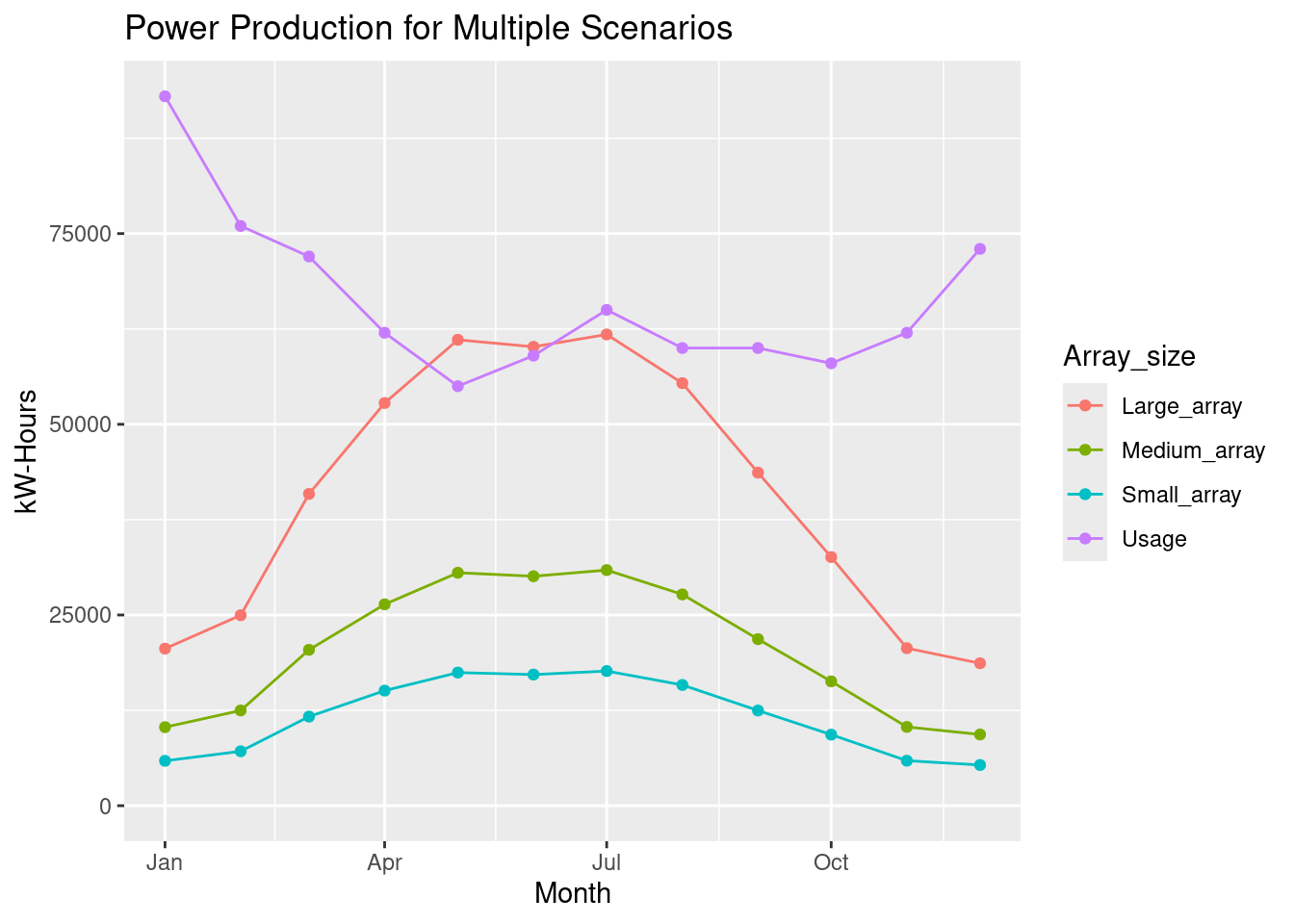

We’ll look at three scenarios, the first one with carport-style panels covering only the flat parking spaces on the garage roof - this is an area of about 800 square meters. The second is a larger structure covering most of the flat area of the garage roof, 1400 square meters. The third scenario would be a large structure covering the entire area of the garage roof, with an area of about 2800 square meters.

Using figures from the National Renewable Energy Laboratory (https://pvwatts.nrel.gov/pvwatts.php), those three scenarios would provide for arrays of about 128 kW, 224 kW, and 448 kW respectively.

Modeling the shade received from nearby buildings, I estimated that November though January the sunlight would be cut by about 50%, while during the summer months of May, June, and July, we would receive full sunlight. Scaling results from the NREL calculator gave monthly net kilowatt hours.

I looked at the last year’s worth of power usage. Of course this was an atypical year, so the numbers for a normal year should probably be greater, but with that caveat, we’ll work with what we have.

Our rate is about 0.0625 per kWh, so at that rate, the small solar array would pay out about 8807.56 dollars per year.

Cost of the carport structure appears to be about $6.20 per square foot, or about $66.40 per square meter. That is an additional expense of about $0.65/kW.

System costs are around $1.65 per watt, or $2.30 per watt with carport, so for a 128 kW system, the cost would be about $270,000. Ignoring net present value, that gives a payout period of 30.7 years. If we could get the 20% tax credit, then the payout period reduces to 24.5 years.

However, our excellent rate is unlikely to improve, and is quite likely to get much more expensive when the current contract expires. Falling oil production yields higher natural gas prices, and ERCOT updates will likely require spending on reserve capacity, all of which will put upward pressure on electricity costs. Our rate could possibly double, from the research I have done.

| System Comparisons With No Tax Credit | |||

|---|---|---|---|

| 33 Years Payout | |||

| System | Size - kW | Cap Cost | Savings (yr) |

| Small | 128 | $294,400 | $8,808 |

| Medium | 224 | $515,200 | $15,413 |

| Large | 448 | $1,030,400 | $30,826 |

| System Comparisons With Tax Credit | |||

|---|---|---|---|

| 25 Years Payout | |||

| System | Size - kW | Cap Cost | Savings (yr) |

| Small | 128 | $217,856 | $8,808 |

| Medium | 224 | $381,248 | $15,413 |

| Large | 448 | $762,496 | $30,826 |

| System Comparisons With Tax Credit and 25% Rate Increase | |||

|---|---|---|---|

| 20 Years Payout | |||

| System | Size - kW | Cap Cost | Savings (yr) |

| Small | 128 | $217,856 | $13,211 |

| Medium | 224 | $381,248 | $23,120 |

| Large | 448 | $762,496 | $46,240 |

| System Comparisons With 1% Loan over 15 years | ||||

|---|---|---|---|---|

| System | Size - kW | Loan Total | Annual net | Annual net +25% |

| Small | 128 | $253,097 | $8,066 | $5,864 |

| Medium | 224 | $442,919 | $14,115 | $10,261 |

| Large | 448 | $885,839 | $28,229 | $20,523 |

Summary

So the various system scenarios would cost from around $300,000 to $1,000,000, including the cost of the carport or roof structure. If the church were to foot the bill directly, because of the lack of a tax credit, the payout would be about 31 years, which is much too long. The tax credit reduces the payout to 23 years, which is better. If we assume our electricity rate will increase by 25%, then the payout period becomes about 18 years, which is pretty good given an estimated 30 year life for the system. Practically speaking, setting up an LLC to build the system - so that they could take the tax break - and paying them some appropriate interest rate, makes the most sense. Assuming a 15 year loan at 1% interest, and assuming our electricity rate rises by 25%, our net cost for power each year would increase by $4,000-$15,000, that is, the cost of paying off the loan compared to what we would have paid for electricity. This is compared to the $50,000 we spent in the past year on electricity, so not a huge increase. And if our rates do go up, it looks even better.